If you’re running a moving company right now, you’re probably noticing some shifts. Fewer calls from the usual ZIP codes. Certain markets that used to boom have cooled. Others, surprisingly, are heating up. And with costs creeping higher — fuel, labor, insurance — you can’t afford to guess where the demand’s going.

At Moving Marketing Results, we work with movers across the country, so we see the trends forming before they make the news. What we’re seeing in 2025 tells us a lot about how 2026 will unfold. The short version? It’s not about who moves the most. It’s about who knows where to be and when.

Let’s walk through what the data’s saying, what regions to keep an eye on, and how movers can adapt.

The Market’s Still Big, But Movement Is Slowing

Yes, Americans are still moving, but not quite as often as they did during the post-COVID boom. According to IBISWorld, the U.S. moving services industry is worth about $23.3 billion in 2025 and growing at around 2.7% annually.

(Source: IBISWorld)

That said, the number of people actually packing up and moving has dipped a bit since the post-COVID rush. Allied Van Lines saw a 7% drop in interstate moves last year. People aren’t moving on a whim anymore. Sky-high mortgage rates and the cost of everything have folks staying put unless they have a really good reason to move.

And those reasons are almost always about finding more space, a lower cost of living, or getting away from high-tax states.

You’ve probably seen the headlines. Texas welcomed over 85,000 new residents last year. Florida gained another 64,000. Meanwhile, California lost more than 239,000 residents. Here at Moving Marketing Results, we see this data play out in real-time with the movers we work with across the country. But knowing the state isn’t enough. You have to know the city.

(Source: Tippet Richardson)

How Home Sales Data Shapes Moving Demand

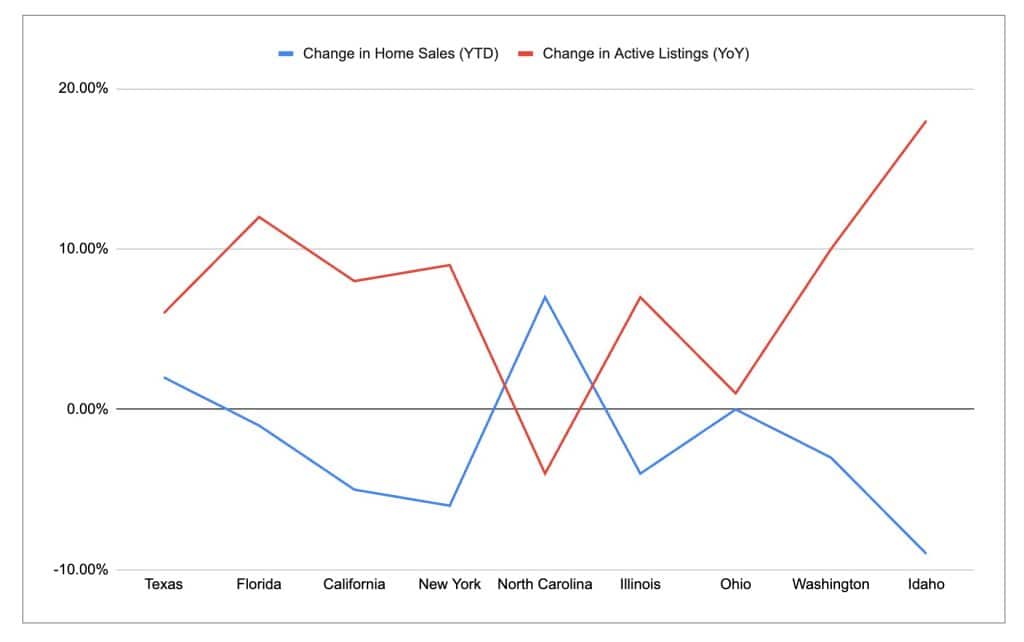

Migration trends tell us where people want to go. Home sales data tells us who is actually pulling the trigger. For a moving company, rising home sales are a direct leading indicator of future jobs. A slowing market means it’s time to adjust your strategy.

Below is a snapshot of projected real estate trends as of October 2025, compared to the previous year. These figures reflect the broader migration patterns and provide a concrete look at where the demand for moving services is shifting.

(Note: The following figures are projections based on year-to-date trends and forecasts from leading real estate analysts as of Q3 2025. They provide a directional snapshot of market velocity.)

Regional Breakdown

Texas. The market is normalizing after its explosive growth, but demand remains robust, especially in suburban areas. Sales are still growing, but inventory is also increasing, providing buyers with more options.

- Homes for Sale (Oct 2025): Approximately 118,000 active listings, a 6% increase compared to Oct 2024.

- Homes Sold (YTD 2025): Approximately 345,000 sold, a 2% increase over the same period in 2024.

Florida. A significant jump in inventory suggests the market is cooling faster than Texas, likely due to soaring insurance costs and affordability challenges in major metro areas.

- Homes for Sale (Oct 2025): Approximately 135,000 active listings, a notable 12% increase compared to Oct 2024.

- Homes Sold (YTD 2025): Approximately 302,000 sold, roughly flat (a 1% decrease) compared to the same period in 2024.

California. The data confirms the outbound trend. A growing number of homes on the market, combined with slower sales, indicates that it’s taking longer for sellers to find buyers, reinforcing the out-migration narrative.

- Homes for Sale (Oct 2025): Approximately 78,000 active listings, an 8% increase compared to Oct 2024.

- Homes Sold (YTD 2025): Approximately 305,000 sold, a 5% decrease from the same period in 2024.

East Coast (A Tale of Two Markets)

- New York (Outbound): Similar to California, inventory is up and sales are down, creating more opportunities for long-distance movers heading south.

- Homes for Sale (Oct 2025): Active listings are up ~9% year-over-year.

- Homes Sold (YTD 2025): Sales volume has decreased by ~6% compared to 2024.

- North Carolina (Inbound): The opposite is happening here. Strong demand keeps inventory tight and sales brisk, signaling a hot market for local and interstate movers.

- Homes for Sale (Oct 2025): Active listings are down ~4% year-over-year.

- Homes Sold (YTD 2025): Sales volume has increased by a healthy 7% compared to 2024.

Midwest (Stable but Shifting)

- Illinois (Outbound): Chicago’s outbound flow impacts state numbers, with more homes sitting on the market.

- Homes for Sale (Oct 2025): Active listings are up ~7% year-over-year.

- Homes Sold (YTD 2025): Sales volume has decreased by ~4% compared to 2024.

- Ohio (Stable): Markets here are less volatile, presenting a consistent, if not booming, opportunity.

- Homes for Sale (Oct 2025): Active listings are nearly flat, up just 1% year-over-year.

- Homes Sold (YTD 2025): Sales volume is also flat, within 1% of 2024 levels.

Pacific Northwest & Mountain West (Cooling Hotspots)

- Washington: The Seattle-area slowdown is lifting statewide inventory.

- Homes for Sale (Oct 2025): Active listings are up ~10% year-over-year.

- Homes Sold (YTD 2025): Sales volume is down ~3% compared to 2024.

- Idaho: The post-pandemic boom has cooled significantly, with inventory climbing as demand stabilizes at a more normal pace.

- Homes for Sale (Oct 2025): Active listings have jumped ~18% year-over-year.

- Homes Sold (YTD 2025): Sales volume is down a sharp 9% from 2024’s pace.

For movers, this data is your map. Focus your marketing and fleet where sales are strong and inventory is moving. In slowing markets, focus on long-distance moves out of state and partnerships with realtors that help sellers relocate.

Citations

- https://www.nar.realtor/research-and-statistics/

- https://www.zillow.com/research/

- https://www.redfin.com/news/data-center/

- https://www.realtor.com/research/

Housing data from the past year reveals a clear shift that every moving company owner should pay attention to. Listings are increasing in most states, but home sales aren’t keeping pace. This means more people are preparing to move than actually following through. Florida, California, and New York are all cooling off, with growing inventory and fewer closings, which often signals more outbound activity. In contrast, states like Texas and North Carolina are holding strong, showing steady or rising sales and continued inbound demand. Those areas are likely to remain reliable markets for local and regional movers as we head into 2026.

For moving business owners, the takeaway is all about positioning. States with more homes for sale but fewer closings may bring new opportunities for long-distance jobs as families relocate to more affordable regions. Meanwhile, places with tighter inventory but stronger sales, like North Carolina, are likely to stay active for local moves. At Moving Marketing Results, we see 2026 shaping up as a year where movers who track these migration and housing trends — and tailor their marketing, staffing, and service areas accordingly — will have a major advantage over those waiting for the phone to ring.

Where People Are Going (and Leaving)

Let’s look at the bigger picture.

- Texas saw +85,267 net domestic migration between mid-2023 and mid-2024

- Florida added about +64,017 new residents

- California lost more than 239,000 people, many of whom moved to nearby states

(Source: ResiClub Analytics)

It’s part of a longer trend that began in 2020. People are leaving high-cost states and heading to places where their money goes further.

You probably already know that.

But the key is understanding which parts of each state are growing, not just the state names themselves.

What to Watch in 2026 By Region

California

Still the biggest outbound state. People are leaving for all the usual reasons: housing prices, taxes, and cost of living. (Source: SmartAsset)

- Net Outflow: Continues: California remains one of the most moved-from states. High housing costs, taxes, and the need for remote work flexibility have prompted many residents to consider more affordable alternatives.

- In-State: Movers who are busy in California are running routes from the Bay Area to Sacramento or from LA to Riverside.

- Top Destinations: Texas, Arizona, and Nevada remain common destinations for Californians relocating.

- Opportunities: Companies offering long-distance or cross-country moves into neighboring states or to Texas are experiencing strong business growth. Partnering with realtors or relocation specialists can bring in more leads. The top destinations for ex-Californians continue to be Texas, Arizona, and Nevada. If you’re based in California, your opportunity isn’t drying up; it’s just shifting. Long-distance and corridor routes are still very active.

Texas

Still pulling in people, but the gold rush has slowed. The shine has worn off in places like Austin, but DFW, San Antonio, and smaller towns are starting to pick up. (Source: MoveBuddha)

Movers in Texas should keep an eye on suburban and exurban growth. That’s where families are landing.

- Inbound Strength: Texas continues to attract new residents, especially to Austin, Dallas-Fort Worth, Houston, and San Antonio.

- In-State Moves: Texas is all about the suburbs. Sure, Houston and Dallas-Fort Worth are the giants, but growth is explosive in the surrounding towns. We’re talking about Frisco and McKinney in the DFW area, and Katy and The Woodlands outside of Houston. If you’re a mover in Texas, your goldmine is in those master-planned communities. That’s where the jobs are, day in and day out.

- Migration Drivers: Lower cost of living, business-friendly climate, and housing availability.

- Trend Watch: Although still growing, demand in cities like Austin has cooled compared to its peak in 2021–2022. Suburban markets surrounding large metropolitan areas are becoming increasingly active.

- Opportunities: Local and regional movers should target suburban expansion zones and work with homebuilders and storage facilities.

Citations

- https://www.excelms.com/allied-migration-report-2024-moving-trends-in-review/

- https://smartasset.com/data-studies/moving-california-2024/

Florida

Still hot for remote workers and retirees, but there’s a shift happening. Insurance costs and extreme weather have slowed growth in areas like Miami, while smaller cities like Ocala and Lakeland are gaining ground.

(Source: ResiClub)

Florida movers are seeing an increase in seasonal moves, senior moves, and specialty requests, such as climate-controlled storage.

- Sun Belt Appeal: Florida remains a top destination for retirees, remote workers, and those leaving Northern states.

- In-State Moves: The Sunshine State is a mixed bag. The crazy boom in Miami is slowing down, partly because of insane insurance costs. The smart money is looking at places like Jacksonville, which boasts a thriving job market, and Central Florida cities such as Lakeland and Ocala. We have seen a huge opportunity for movers who can cater to the wave of retirees heading to communities around Ocala. It’s a steady, reliable market.

- Shifting Preferences: More people are looking to move into mid-sized cities like Sarasota, Lakeland, and Ocala, rather than just Miami or Tampa.

- Challenges: Rising home insurance costs and flood risks could impact move-in rates in some coastal areas.

- Opportunities: Movers can promote services tailored to senior relocations, seasonal moves, or climate-controlled storage in high-humidity regions.

“Idaho and South Carolina led domestic migration growth between 2021 and 2025, gaining over 3.0% of their populations through domestic relocations, while states like California, New York, and Illinois saw significant but slowing outflows.”

Citations

- https://www.movebuddha.com/blog/move-to-texas-migration-report

- https://www.resiclubanalytics.com/p/net-domestic-migration-which-states-are-gaining-and-losing-americans

- https://www.credaily.com/briefs/americans-move-to-new-hotspots-as-migration-shifts-in-2025/

- https://www.placer.ai/anchor/reports/the-great-slowdown-domestic-migration-into-2025/

East Coast

The Northeast continues to lose residents to the South. People from New York, New Jersey, and Massachusetts are heading to Georgia, the Carolinas, and Florida.

(Source: North American Van Lines)

There’s also a steady trend of city dwellers moving out to the suburbs. Movers here should explore I-95 corridor routes and partnerships beyond the core metro zones.

- Outbound from the Northeast: States such as New York, New Jersey, and Massachusetts are experiencing consistent outflows, particularly to Southern states like North Carolina, Georgia, and Florida.

- Urban-to-Suburban Trends: In metro areas like Boston, Philadelphia, and D.C., more residents are moving outward to suburbs or even rural areas.

- In-State Moes.

- The volume is in New York City and its suburbs on Long Island. But the trend is “out.” Movers are busy with two kinds of jobs. The long-distance hauls from Brooklyn to North Carolina, and the shorter trips from a Manhattan apartment to a house in Westchester. There’s also a small but interesting trickle of people moving upstate to places like Buffalo for a super-affordable lifestyle.

- Virginia is really two different worlds. First, you have Northern Virginia, which is basically a massive, wealthy suburb of Washington D.C. Places like Fairfax and Loudoun County are swimming in moves from government and tech workers. Then you have Richmond, which has become a trendy hotspot for people looking for a cool, mid-sized city. And don’t forget Virginia Beach, where the military keeps the moving industry busy all year round.

- Pennsylvania isn’t one market; it’s two, with a whole lot of country in between. You’re either in Philly’s world or you’re in Pittsburgh’s. In the east, Philadelphia and its massive suburbs act like a classic East Coast hub. In the west, Pittsburgh is its own affordable, revitalized universe. Your money in the Philly area is made on the constant churn of families moving from the city to the wealthy “Main Line” suburbs. In Pittsburgh, you’re tapping into a steady stream of younger folks and boomerang residents chasing the city’s incredible affordability.

- Maryland’s moving market is a tale of two very different cities: the D.C. suburbs and Baltimore. Full stop. The incredible amount of federal government and contractor money churns endlessly through affluent suburbs like Bethesda and Rockville, creating a constant stream of high-value moves. Baltimore offers a gritty, more affordable alternative.

- Opportunities: Interstate movers should focus on corridor routes from the Northeast down the I-95 corridor and consider advertising in suburban and secondary city markets. xYour bread and butter is the high-end corporate and government relo in the D.C. suburbs. The smart play is also tapping into the growing flow of people moving from the D.C. area to Baltimore to get a break on housing costs.

Citations

- https://www.northamerican.com/migration-map

- https://www.atlasvanlines.com/resources/migration-patterns

Midwest

Overall pretty steady, but large cities like Chicago and Detroit are seeing slow trickles outward. That said, a small wave of people is returning to the Midwest after trying out other regions during the pandemic.

(Source: Atlas Van Lines)

The opportunity lies in service — people value reliability and transparent pricing above all else in these markets.

- Slow Growth, Stable Base: The Midwest sees fewer moves overall, but many residents are relocating within state lines.

- City to Suburb: Major cities like Chicago, Detroit, and St. Louis are experiencing outbound flows to nearby suburbs or Southern states.

- In-State Moves

- Ohio is the definition of a stable market, driven by the “Three Cs”: Columbus, Cleveland, and Cincinnati. Columbus is the clear growth engine, pulling in young professionals and families to its suburbs. Cleveland and Cincinnati are your steady workhorses, full of local moves from people chasing the state’s rock-solid affordability.

- Illinois. Let’s be honest, the market in Illinois is Chicago. Full stop. The city and its suburbs like Naperville and Aurora have tons of volume. The main story is people moving from the city out to the suburbs for more space.

- Return Migration: A trend has emerged among some movers who return home to Midwestern states after living in coastal metropolitan areas.

- Opportunities: Regional moving companies can benefit from offering value-focused services and building loyalty through repeat and referral business.

- Your bread and butter in Ohio is that local suburban move, plus the steady stream of long-distance jobs for people leaving the state altogether. Your growth market is the inbound traffic to Columbus.

- For Illinois, your money is made by being the most reliable local mover on the block, handling the constant, predictable churn within the Cleveland and Cincinnati metros.

Citations

- https://www.atlasvanlines.com/resources/migration-patterns

- https://smartasset.com/data-studies/migration-patterns-between-regions-2024

- https://www.nar.realtor/research-and-statistics/research-reports/migration-trends

Pacific Northwest

Cities like Seattle and Portland have cooled off. However, places like Boise, rural Oregon, and parts of Washington are attracting people who seek space and simplicity.

(Source: ExcelMS)

Movers in this region can stand out with rural-friendly service, reusable packing gear, and flexible schedules.

- Mixed Migration: Cities like Portland and Seattle are seeing some outbound movement due to cost of living, but rural and scenic areas in Oregon, Washington, and Idaho are gaining popularity

- Instate Moves.

- Washington State. Washington’s moving scene is all about one thing: escaping Seattle’s price tag. The entire market is a ripple effect from the tech boom in Seattle and Bellevue. As costs in the core metro have skyrocketed, people are cashing out and heading either south to Tacoma or making the long haul over the mountains to Spokane.

- Idaho. Let’s be clear about Idaho: the gold rush is over. For a few years, Boise was the hottest ticket in the country, a frenzy fueled by people fleeing the coast. Now the market is finally catching its breath and returning to normal. The explosive boom has cooled into a more stable, predictable flow of new residents.

- Remote Work Impact: Many remote workers are relocating to smaller towns for a quieter lifestyle and more space.

- Opportunities: Movers in this region can grow by offering flexible scheduling, eco-conscious options, and routes covering both urban and rural destinations.

- Your two biggest money-making routes are the short hauls from Seattle to Tacoma and the cross-state trek to Spokane. Every person who gets priced out of a Seattle home is a potential customer for one of those two trips.

- The California-to-Boise route is still your bread and butter, but it’s not the wild west it used to be. The game is now handling the steady stream of families moving into Boise’s suburbs, such as Meridian, in a market that is far more competitive than it was during the peak frenzy.

Citations

https://www.atlasvanlines.com/resources/migration-patterns

| 2024 Top 10 Inbound |

| 1. Arkansas |

| 2. Rhode Island |

| 3. North Carolina |

| 4. Washington, D.C. |

| 5. Idaho |

| 6. Tennessee |

| 7. Maine |

| 8. Connecticut |

| 9. Washington |

| 10. Alaska |

| 2024 Top Outbound |

| 1. Louisiana |

| 2. California |

| 3. Illinois |

| 4. South Dakota |

| 5. New York |

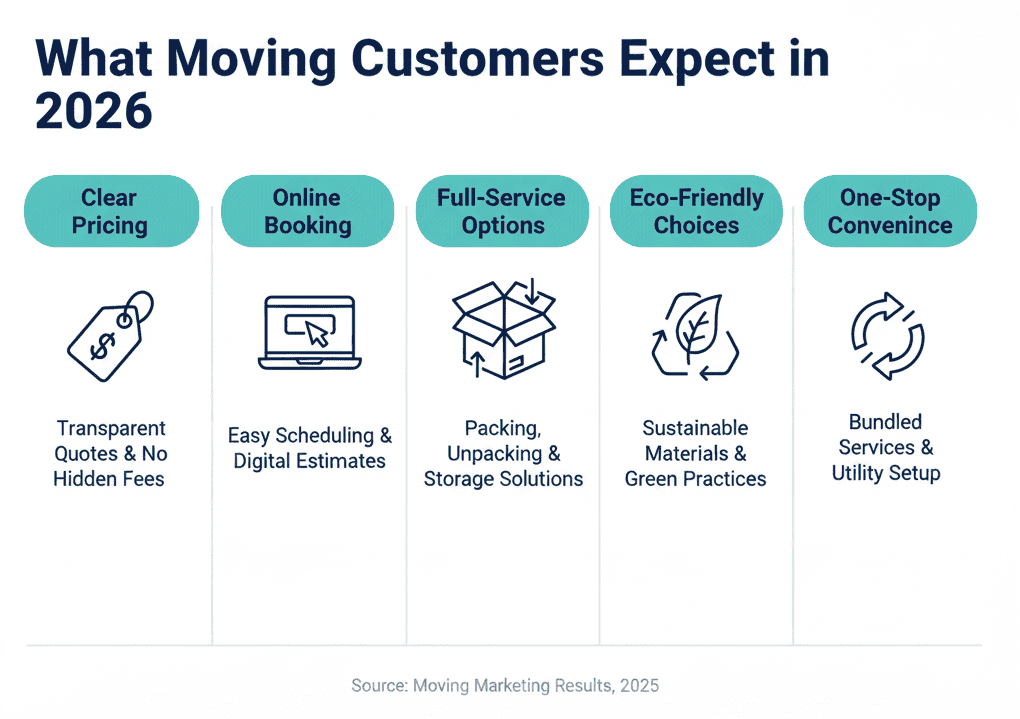

What Customers Want in 2026

It’s not just about showing up with a truck and a couple of guys anymore. Customers are more picky than ever, and they expect a lot more than just a basic move.

They want everything to feel transparent, smooth, and managed.

That starts with the quote.

No more vague pricing

People don’t want to be told “we’ll figure it out on moving day.” They want to know upfront what it’s going to cost, labor, supplies, fuel, stairs, whatever. All of it.

According to IBISWorld, moving companies that added online quoting and tracking tools are seeing more satisfied customers and stronger word-of-mouth.

You don’t have to offer a flat rate every time. But you do have to make it easy for someone to know what to expect — and that they’re not going to get slammed with extra fees after the job is done.

It’s not just about moving anymore

The best-performing moving companies we work with aren’t just moving people’s stuff. They’re offering solutions for all the mess that comes with a move.

Things like:

- Junk removal

- Appliance pickups or deliveries

- Pre- and post-move cleaning

- Furniture delivery and assembly

- Storage runs

- Mattress haul-away

- Staging assistance

And no, you don’t need to hire all those people in-house. Most of our clients establish partnerships with local vendors and incorporate those services into their quotes.

IBISWorld reports that about 13.5% of total industry revenue now comes from services like these: packing, hauling, delivery, and more.

It’s good for the customer, who doesn’t want to manage five vendors. And it’s good for you, because it builds trust and makes your company more valuable.

What customers expect now:

- Clear, upfront quotes

- Easy online booking and updates

- Service bundles that save time

- Eco-friendly options like reusable bins

- One call that solves their whole move, not just the truck

We see the companies offering this kind of all-in-one approach landing more jobs, getting more reviews, and building loyal followings.

The Risks You Can’t Ignore

Let’s not sugarcoat it. This business is getting tougher.

Insurance costs are climbing. Fuel prices bounce around. Labor’s harder to hire and keep. And depending on your state, you could be one new rule away from a compliance headache.

Add in climate risks like fires, floods, and hurricanes — yeah, there’s a lot to watch.

That’s why it matters so much to know where the growth is happening and where it’s stalling out. You can’t afford to waste time and money chasing leads in markets that are shrinking.

Bottom Line

If you’re running a moving company in 2026, you’re not just in the business of moving stuff. You’re in the business of solving stress.

Your ability to read migration trends, understand what customers want, and make life easier on moving day — that’s what’s going to set you apart.

At Moving Marketing Results, we help movers figure all this out and get their message in front of the right people. If you’re ready to grow smarter instead of just working harder, let’s talk.